Why an IPO Gives CVC Capital an Edge in Private Equity

Plus: Bain Capital is interested in Envestnet and Blackstone is in talks to acquire music rights investor.

You’re reading Value Add’s weekly briefing, the leading newsletter for the operating side of private equity. Here’s what you need to know this week, from insights for PE-backed executives and portco news to recent buyouts and investment trends.

Insights

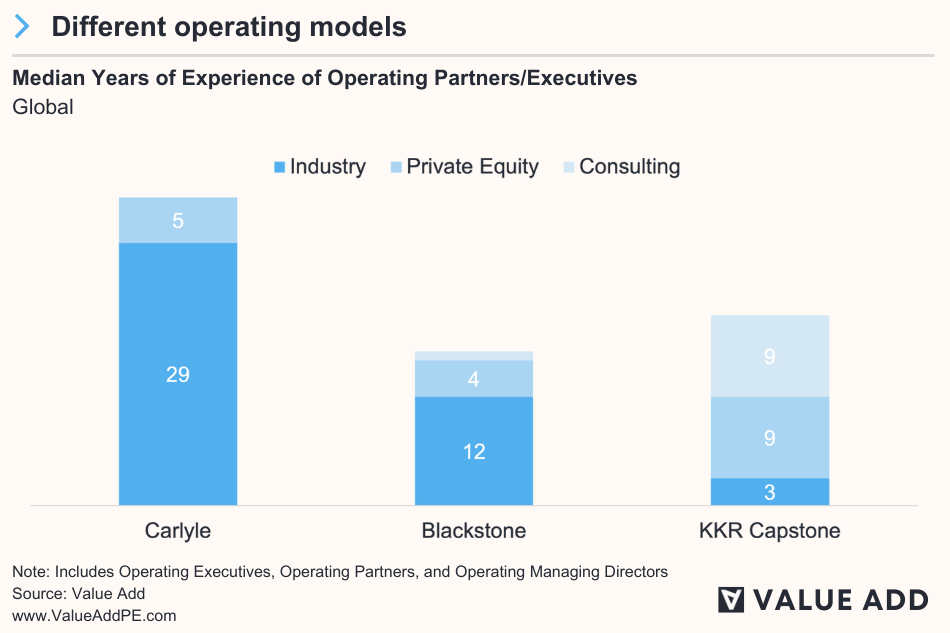

Chart of the Week: A notable feature of Carlyle’s portfolio operations team is its depth of experience. The median professional experience of a Carlyle operating executive spans 34 years – 29 of which come from working in industry. For comparison, a managing director at KKR Capstone typically has 21 years of experience, with just three years from industry. This indicates Carlyle’s stronger preference for industry tenure in its executives, as opposed to KKR and Blackstone, which are more receptive to candidates from diverse backgrounds, such as MBB consulting or private equity investment roles. (Read More)

More Insights

- CEO Turnover is Highest in PE-backed Technology Buyouts (Read)

- Japan’s Share of Global Buyout Activity Reaches All-Time High (Read)

- Private Equity Firms are Getting Out of Consumer Businesses (Read)

- What Carlyle Group Looks for in Operating Executives (Read)

- Cybersecurity in Private Equity Report (Read)

Spotlight

CVC Capital, which manages approximately €186 billion in assets, is expected to raise between €1 billion and €1.5 billion as part of its anticipated public listing on the Euronext Amsterdam. Approximately 10-15% of the firm’s shares are expected to be sold in the offering, valuing it between €13 billion to €15 billion. CVC recently raised €26 billion in what was the largest buyout fund ever (CVC Capital Partners IX), so why would the European buyout giant be raising capital in public markets?

One reason is that PE firms are increasingly seeking to make longer-term investments with so-called “permanent capital” that doesn’t require returning liquidity to LPs within the traditional 10-year period of a fund. We know this is influencing CVC wanting to go public, because its prospectus even states very clearly: “the contemplated IPO will provide an enduring long-term institutional structure.”

Now PE firms have their sights set on permanent capital. Private equity “dry powder,” the so-called capital commitments that buyout firms have secured from institutional investors, has grown 20x since the 1990s. But during economic downturns, LPs can become sheepish like many investors, limiting the amount of capital that private equity dealmakers have access to.

- 2000s Dot-com Crisis: -27% decline in US buyout activity and capital calls (investors calling to deploy LP commitments) dropped -23% below the historical averages.

- 2007-2009 Financial Crisis: PE fundraising fell -40% and the time to close funds increased to an average of 18.4 months in 2009, 12 months longer than it was in 2007.

- COVID-19: Quarterly fundraising fell sharply from $250 billion in Q4 2019 to $100 billion in Q2 2020.

Ironically, these downturns in which capital was more difficult to come by also happened to be some of the best times to deploy capital as asset prices were temporarily discounted and private markets inevitably recovered. While PE firms are adaptable to market conditions and typically rebound stronger, many began realizing that access to permanent capital is crucial. A shift towards “permanent capital” allows firms to secure long-term commitments from their LPs, public markets, or other sources in order for funds to be more accessible. Overall, permanent capital is shown to increase the resilience of PE firms during market downturns, and allow them to generate higher returns relative to competitors during a market recovery.

CVC has some experience making long(er)-term investments. In 2016, CVC closed on a new $5 billion, strategic opportunities fund that it said would be intended specifically for “long-term investments” with a 15-year window. The fund offered a longer capital commitment period than its standard five years, and in return, LPs received lower fees and steadier returns in exchange for the long-term commitment. Some of the fund’s investments include a 50% stake in RAC Group Ltd. and a material ownership in Moto Hospitality Ltd.

While CVC’s initial long-term fund attracted commitments from some existing LPs, such as Singapore’s sovereign wealth fund, PE firms often have to fundraise outside traditional channels to raise so-called permanent capital.

With permanent capital, investments are steady and compound over years. This strategy avoids frequent buying and selling of portcos and emphasizes long-term, gradual growth instead. Permanent capital also relies less on leveraged debt that is associated with traditional private equity models. With debt, fund managers are required to generate returns faster in order to avoid overturn. But with a strategy anchored around gradual investment growth, utilizing debt isn’t the focus. These structures aim to attract investors who are aligned with a buy-and-hold strategy. Typically you’ll see these fund managers turn to different LP archetypes such as institutional investors with long-term investment goal horizons and large family offices that have surplus liquidity.

However, even long-term LP commitments come with strings attached, and PE firms are increasingly looking to public markets as a way to raise capital. KKR and Blackstone initially raised a combined $5.4 billion during their IPOs in 2007. As publicly-traded companies, they’ve been able to tap public markets to finance certain deals that don’t meet LPs requirements. For example, KKR priced $1 billion worth of its shares in public markets to raise capital for the buyout of Global Atlantic Financial Group Limited, a retirement and life insurance company.

With an IPO, CVC will now join other leading mega-funds in being able to more easily access public markets giving it more flexibility to finance deals during market downturns or in opportunities that are more long-term and less aligned with LP objectives.

Buyout News

Blackstone is in talks to acquire Hipgnosis, which owns the music rights to several popular artists, for $1.5 billion. Blackstone outbid Nashville-based Concord Chorus, another music company, in the deal. Hipgnosis has faced governance and regulatory challenges over the years, and its board quickly agreed to sell once takeover offers started to come in. (Source)

Bain Capital is among several PE firms interested in acquiring Envestnet, which makes software for financial advisors. The company has a market cap of $3.5 billion and last year generated EBITDA of $122 million. Its stock price is up +25% YTD, but still down slightly from its highs in 2021. Activist investors have been pushing Envestnet to cut costs, which recently led to its current CEO to step down. (Source)

Arctos raised $4 billion for a new fund that will target investments in the US sports industry, including sports teams, licensing deals, media rights, and other assets. The firm decided to focus on US investments for this fund citing “volatility” in European football leagues and displeasure for how team performance decides how much broadcast revenue a team generates. “Every owner in North America gets paid the same amount from its league, no matter if they’re in first place or last place,” according to the firm’s Co-founder Ian Charles, making it “more predictable than just about anything else you can invest in private markets.” (Source)

CVC Capital has expressed an interest to acquire the Italian operating arm of accountancy giant EY. The business unit generated €366 million in revenue last year, which is about one-tenth the size of the company’s UK business. The buyout firm issued a letter of interest, but no talks have been had yet.(Source)

Vista Equity is preparing to close a new $20 billion fund that will invest heavily in technology companies that stand to benefit from AI disruption. Founder Robert Smith says the firm has been impressed by the impact AI technologies have had on performance improvement in its existing portfolio companies. (Source)

EQT AB is considering taking chemical distributor Azelis private (again), after it acquired the company in 2018 and then took it public in 2021. The PE firm thinks Azelis is undervalued, as it’s trading -20% lower than its IPO price. (Source)

Portco News

Bridgepoint wants to exit Swedish drink maker, Vitamin Well, after holding the company for eight years. The business generated €500 million in revenue last year, EBITDA of €150 million, and is expected to be valued at over €2 billion. Bridgepoint first invested in the company through a growth fund that backs companies worth up to €200 million, suggesting a sizable return on its investment if the company is able to garner a valuation in the billion of euros. (Source)

Blackstone sold $1.1 billion worth of stakes in private equity holdings to Ares. It’s the largest secondaries deal that Ares has done to date. Meanwhile, Ardian is also nearing a deal to acquire a portfolio of assets worth $1 billion from British Columbia Investment Management Corp. (Source)

Questions? Email us: editor@valueaddpe.com