Cybersecurity Firm Darktrace Poised for Breakout Year After Thoma Bravo Acquisition

Plus: GTCR is acquiring AssetMark Financial for $2.7 billion, beauty brand KIKO Milano join L Catterton, and the drama surrounding Paramount 's potential takeover continues.

You’re reading Value Add’s weekly briefing, the leading newsletter for the operating side of private equity. Here’s what you need to know this week, from new insights for PE-backed executives and portco news to recent buyouts and investment trends.

Insights

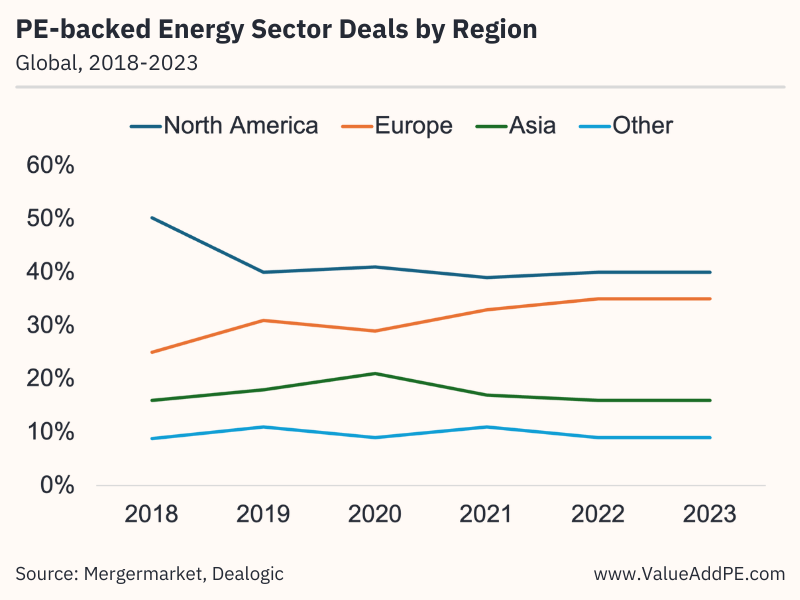

Chart of the Week: While North America still leads in PE-backed energy deals, its global share has decreased from 50% to 40% since 2018, contrasting with Europe's rise from 25% to 35%, bolstered by robust renewable energy policies and strong government incentives. Asia's share has stayed consistent at around 16%, with a temporary spike to 21% in 2020. The growth in private equity investments in Europe is driven by aggressive renewable initiatives, a mature market, societal emphasis on sustainability, and a tradition of socially responsible investing, making it a more attractive environment for private equity. (Read More)

More Insights

- Energy Sector Private Equity Report 2024 (Read)

- CEO Turnover is Highest in PE-backed Tech Buyouts (Read)

- Japan’s Share of Global Buyouts Reaches All-Time High (Read)

- PE Firms are Getting Out of Consumer Businesses (Read)

- What Carlyle Group Looks for in Operating Executives (Read)

Spotlight

Thoma Bravo is acquiring Darktrace, a UK-based cybersecurity company, for $5.3 billion. The all-cash offer represents a +44% premium to its three-month volume-weighted average price and a +20% premium to its most recent closing price. Darktrace initially denied previous bids made by Thoma Bravo, but the PE firm was persistent and kept increasing its offer in order to get the deal done. The transaction is expected to close by the end of 2024.

About Darktrace. The company was founded in Cambridge, UK in 2013, and is well-known for its cybersecurity solutions, some of the first to utilize self-learning AI to counteract cybersecurity threats. Its technology supports over 9,400 customers including Allianz, Airbus, and the city of Las Vegas.

What drove Darktrace to go private? Despite its advanced technology, Darktrace's valuation has historically lagged behind its key competitors. The company’s management team has been outspoken about public markets – especially those traded on the London Stock Exchange – undervaluing the company’s innovation. It’s the latest in a slew of companies delisting from the LSEG, including Arm Holdings, Flutter, and CRH.

Why is PE interested in Darktrace? The deal aligns with the current trend of PE firms taking undervalued tech companies private. In this case, the acquisition’s total enterprise value represents 34x Darktrace’s adjusted EBITDA ($146 million) for the twelve months ended December 31, 2023. This appears to be an aspirational multiple, but the company’s 1H2024 results were largely impressive. Darktrace reported $330 million in revenues, over +27% growth year-over-year, and $702 million in ARR. Its annual recurring revenue is very strong due to over 99% of its revenue coming from subscriptions. Further, the company is well-diversified geographically with 34% of revenues coming from the US, 24% from Europe, 15% from the UK, and 25% from the rest of the world. Other key highlights from its recent earnings included a large backlog of client deliverables worth $1.3 billion, a customer base shifting towards larger contracts, and a strong retention rate of 105%. Darktrace raised its revenue expectations for FY2024, now anticipating +24% to +25% revenue growth for the year.

Aside from solid financial performance and trajectory, another interesting angle explaining the company’s under-appreciation is apparent concern that the public market has had with Mike Lynch, Darktrace’s co-founding investor. He is currently facing fraud and conspiracy charges in the U.S. and still holds a 7% stake with his wife. The couple will make $377 million from the sale, possibly aiding Lynch's legal support, but more importantly removing Lynch’s association with the company going forward.

What could Thoma Bravo’s value creation plan look like for Darktrace? With strong financials and continued double-digit growth, Thoma Bravo will likely be fairly hands-off with Darktrace. The PE firm’s Andrew Almeida, who helped to lead the deal, praised Darktrace’s focus on innovation and AI capabilities and expressed excitement for the company’s growth roadmap. That said, Thoma Bravo is one of the largest PE investors in the cybersecurity space and will be able to help share best practices and introduce Darktrace to new potential verticals and markets.

Buyout News

PE firm GTCR is acquiring AssetMark Financial, a wealth management platform, for $2.7 billion. The company reported $709 million in revenues last year and EBITDA of $213 million. Its stock price has increased about +24% since its IPO in 2019, underperforming other companies in the fintech space. Analysts from William Blair published a note saying the offer “feels somewhat low … However, reports of a potential deal were reported by Bloomberg in December, which suggests that if there were other potential buyers at a higher price, they likely would have emerged by now.” (Source)

The drama surrounding Paramount’s potential merger with Skydance Media, which is backed by KKR and RedBird Capital, continues. Paramount CEO Bob Bakish has been abruptly axed from the company, raising suspicion about infighting with majority-owner Shari Redstone about a potential takeover. (Source)

Apollo is acquiring US Silica Holdings, an industrial minerals company that injects sand to expose oil embedded in rock, for $1.9 billion. The company reported $1.6 billion in revenues last year and EBITDA of $416 million. US Silica has survived several boom-bust cycles in the frack-sanding market. Sand prices surged +50% last year as large parts of the globe faced an energy crisis bringing back a demand for fracking; but, over the long-term sand prices have steadily declined as miners have been able to source materials locally in Texas, closer to large oil mining operations. (Source)

L Catterton, the private equity arm of luxury house LVMH is acquiring KIKO Milano, an Italian make-up brand, for $1.5 billion. The family-owned company reported $860 million in revenues last year, up +20% YoY, and has a strong online presence as well as brick-and-mortar distribution with over 1,100 of its own stores. (Source)

SKKY Partners, the new PE firm affiliated with Kim Kardashian, has raised just one-tenth of its intended fundraising goal for a new fund. The firm has landed just one deal to-date, a minority investment in CPG brand Truff. (Source)

Portco News

KKR is halting a potential sale of Upfield, the maker of Country Crock spreads (which most people probably know from its “I can’t Believe It’s Not Butter” products). The PE firm was seeking a valuation of $10 billion for the company, and it did attract interest from Abu Dhabi Investment Authority, but discussions ultimately led nowhere. KKR acquired Upfield for $7.3 billion in 2017 during a carve-out deal from Unilever so exiting to another strategic acquirer is unlikely and makes an IPO a more likely go-forward plan. (Source)

Ardian is selling Audiotonix, a manufacturer of professional audio equipment that is used in stadiums by major artists and sporting events, to PAI Partners. The deal is valued at over $2.5 billion. Ardian acquired the company in 2020 and supported its investments in R&D and several M&A transactions. Last year, Transom Capital acquired Bose’s professional audio equipment business. (Source)

L Catterton-backed Barcelona Wine Bar, a tapas concept restaurant, has hired Amy Hom as Chief Operating Officer. Hom previously held leadership roles at Red Robin, Sweet Green, and California Pizza Kitchen. (Source)

Questions? Email us: editor@valueaddpe.com