Blackstone is in Talks With Jersey Mike's

Plus: Bain Capital exits Zellis and KKR remains bullish on Japan.

You’re reading Value Add’s weekly briefing, the leading newsletter for the operating side of private equity. Here’s what you need to know this week, from new insights for PE-backed executives and portco news to recent buyouts and investment trends.

Insights

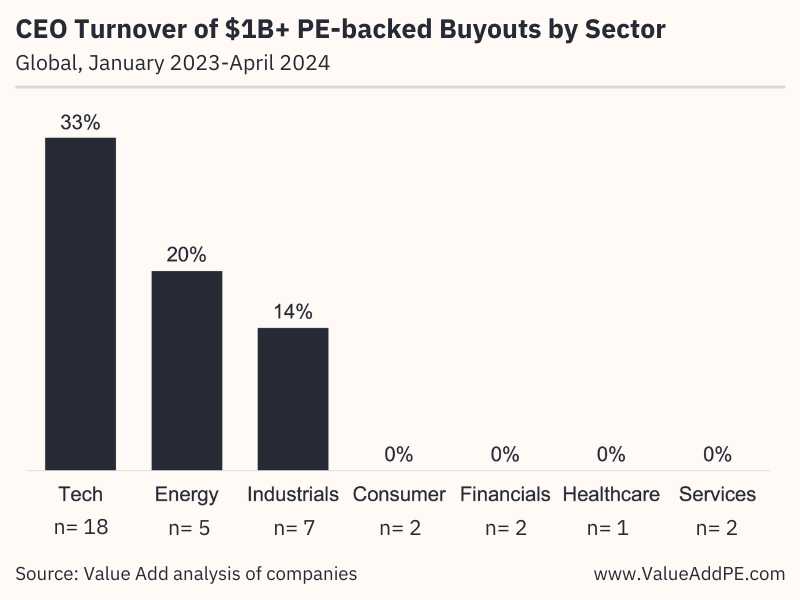

Chart of the Week: 33 percent of PE-backed technology buyouts last year have already replaced their CEOs, according to analysis by Value Add. Excluding tech companies, only 11% of PE-backed CEOs have been replaced over the same time period, which is on par with CEO turnover in publicly-traded companies. The data suggests that management changes are still very much a value creation tactic used by PE firms but not as broadly across industries as one might expect. (Read More)

More Insights

- CEO Turnover is Highest in PE-backed Technology Buyouts (Read)

- Japan’s Share of Global Buyout Activity Reaches All-Time High (Read)

- Private Equity Firms are Getting Out of Consumer Businesses (Read)

- What Carlyle Group Looks for in Operating Executives (Read)

- Cybersecurity in Private Equity Report (Read)

Spotlight

Blackstone is in talks to acquire Jersey Mike’s, a popular sandwich chain, for $8 billion. It would be the second major US buyout of a large quick-service restaurant in the past year, following Roark Capital’s $9.6 billion acquisition of Subway. However, other than the fact that both restaurants are known for their made-to-order sandwiches, the two businesses couldn’t be more different in terms of how PE firms will approach their value creation strategy for each.

Subway has over 20,000 restaurant locations with stalling growth of around $10 billion in sales a year. Jersey Mike’s has a little over 2,500 locations, adding 400+ more a year, and just over $3 billion in annual sales which are forecast to more than double by 2027. Subway generates approximately $450,000 per restaurant while Jersey Mike’s tops over $1 million per location. Jersey Mike’s also has very strong customer satisfaction and loyalty with its “carryout score” ranking higher than any other fast casual restaurant, according to a survey by Technomic Ignite.

Given the differences between the two businesses, Blackstone will likely treat Jersey Mike’s as a growth investment while Roark will view Subway as more of a turnaround to revitalize the brand and improve profitability by store. Roark is perhaps more well-known in the franchising space, given its investments in Arby’s, Buffalo Wild Wings, Dunkin’, and Jimmy John’s. However, Blackstone has also been getting more involved in the restaurant industry, investing in 7 Brew, a fast-growing coffee chain in the US.

Buyout News

Bain Capital has agreed to sell payroll software provider Zellis for $1.6 billion to Apax Partners. Bain acquired the company in 2017, and installed a new management team including John Petter as CEO and Abigail Vaughan – both hired in 2019 . Zellis reported a CAGR of 20% over the past three years, driven by companies’ migrating HR and payroll products to cloud-based platforms. (Source)

KKR continues to be very bullish on investment opportunities in Japan. “We generated more [returns] in this market than in many other places for a lot of reasons that aren’t obvious,” said Joseph Bae. “It’s low valuations, big conglomerate structures with a lot of non core businesses, massive room for operational improvement.” (Source)

Evolution Equity raised $1.1 billion for a new fund targeting cybersecurity buyouts. (Source)

Portco News

Prakhar Mahrotra, a former technology executive at Walmart, has been hired by Blackstone to apply AI best practices across its 230+ portfolio companies. Blackstone has built one of the larger operating groups in private equity, helping portfolio companies with everything from digital transformation and business intelligence to branding and creative. Value Add’s recent report, “AI in Private Equity,” outlines some potential use cases for AI in portfolio companies including augmenting customer service teams, marketing content creation, and advanced analytics to make better business decisions. (Source)

Apollo-owned Michaels, the retailer known for crafting and DIY products, received an upgraded credit rating from S&P Global Ratings thanks to improved operating margin and cash flow. Declining transportation costs have provided an unexpected EBITDA benefit for many retailers, which could make the industry more attractive to private equity. (Source)

Scott Nuttall and Joseph Bae, co-CEOs of KKR, say exit opportunities are opening up for portfolio companies. “We’re starting to get more approaches from strategic buyers,” they told the FT. “IPO markets are [also] starting to open up.” (Source)

Questions? Email us: editor@valueaddpe.com