Why KKR and Apollo Are So Interested in Paramount

Plus: $6B buyout of US utility company Allete, EQT acquires tech consultancy Perficient, and Sycamore leads buyout interest for Nordstrom.

You’re reading Value Add’s weekly briefing, the leading newsletter for the operating side of private equity. Here’s what you need to know this week, from insights for PE-backed executives and portco news to recent buyouts and investment trends.

Insights

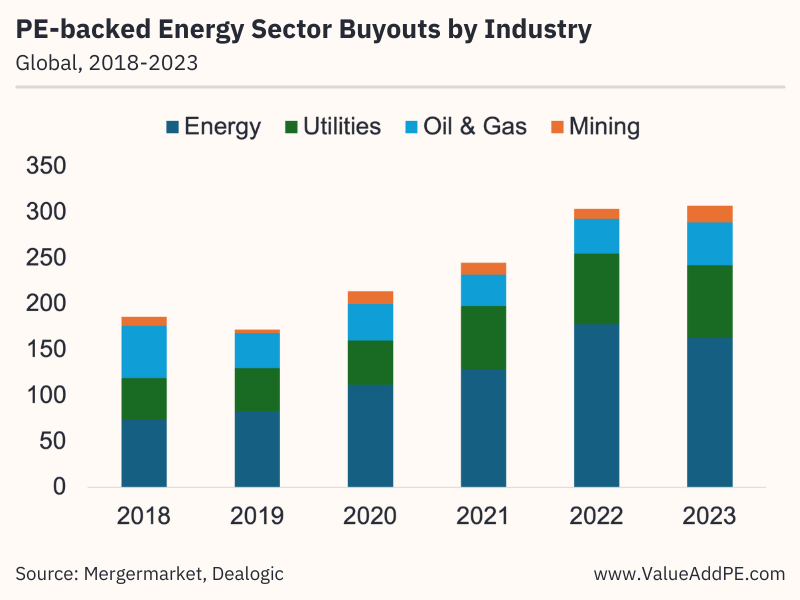

Chart of the Week: Utility companies account for the second-most private equity buyouts in the energy sector at the moment, but the second-least exits, according to our 2024 Energy Sector Private Equity Report. It suggests that PE firms are acquiring utility companies faster than they are exiting them as the "electrification of everything" is driving-up energy grid usage. (Read More)

More Insights

- Energy Sector Private Equity Report 2024 (Read)

- CEO Turnover is Highest in PE-backed Tech Buyouts (Read)

- Japan’s Share of Global Buyouts Reaches All-Time High (Read)

- PE Firms are Getting Out of Consumer Businesses (Read)

- What Carlyle Group Looks for in Operating Executives (Read)

Spotlight

What’s the deal? The drama surrounding a potential takeover of Paramount continues ... Within the past week, CEO Bob Bakish was ousted by Shari Redstone, the exclusive negotiation window with KKR-backed Skydance expired, Sony made a $26 billion all-cash offer with the help of Apollo Global Management, and Warren Buffet revealed that he’s exited his position entirely in the company after “losing quite a bit of money.”

As of May 6th, it’s looking like Paramount may continue to operate as a publicly-traded company, as entertainment executive Jeffrey Katzenberg says regulators will never allow a private equity firm or foreign enterprise control a major US media company the size of Paramount.

The precedent for large PE-backed mega-deals in entertainment. There are a number of comparable deals in the entertainment industry from the past. Entertainment companies, specifically film studios, are often targets due to their high-profile status, significant capital requirements, and desirable assets stemming from distribution channels such as streaming services, direct-to-consumer platforms, and more. Below is a brief guide to former deals in the entertainment space.

- Sony’s PE-backed buyout of MGM Studios: In 2004, MGM was acquired by an investor group comprised of Sony, Providence Equity Partners, TPG, Comcast, and DLJ Merchant Banking Partners. MGM was very engaged in global film and TV production and, at the time, owned the largest library of modern films which consisted of 4,000 titles. The deal was valued at nearly $5 billion and was Sony’s gateway to MGM’s extensive film library. However, things would take a turn for the worst when MGM ultimately filed for Chapter 11 in 2010. About a decade later, in 2021, Amazon would acquire MGM for approximately $8.5 billion.

- Dune Capital’s funding of 20th Century Studios: Dune Capital enjoyed a relationship with 20th Century Studios from 2005 to 2013. The initial agreement in 2005 was a $325 million investment to finance 28 feature films. Dune would undergo several more slate financing deals with 20th Century over the years, a sign of what was a successful partnership. Around the time of the 2007-08 economic crisis, the entertainment industry was largely shunned by lenders as many exited the sector. Dune, however, remained committed to 20th Century which helped fund the production of Avatar, the highest-grossing film of all-time. Dune ultimately had to dissolve its fund due to struggles with real estate holdings, but 20th Century and Fox would continue to receive financial support from former Dune-affiliates over years.

- Silver Lake's take-private of WME Entertainment: Just last month, Silver Lake announced its agreement to acquire Endeavor Group Holdings, owner of Hollywood talent agency WME Entertainment. The deal has a $13 billion equity value and $25 billion consolidated enterprise value. It’s the largest take-private deal of an entertainment company in over 10 years. The acquisition follows Silver Lake’s strategic investment in TEG in 2019. TEG is Asia Pacific’s leading global live entertainment and ticketing company. While Endeavor and TEG are not film producers, the deals still demonstrate the recent momentum by private equity in the entertainment industry.

KKR and Apollo’s experience in entertainment. If KKR-Skydance or Apollo-Sony are successful in acquiring Paramount, it wouldn’t be their first major holding in the entertainment industry. Both PE firms have extensive experience with film studios and publishers.

- KKR’s Entertainment Holdings

- Regal Entertainment Group consists of Regal Cinemas, Edwards Theatres, and United Artists Theatres. Regal “operates one of the largest and most geographically diverse theater circuits in the United States, consisting of 5,785 screens in 426 theaters in 41 states along with the District of Columbia and Guam as of April 2024.”

- RBmedia is one of the largest independent audiobook publishers and distributors. KKR purchased the company in 2018 for a reported $500 million. Since then, “RBmedia has more than doubled the size of its catalog – from over 31,000 to over 66,000 audiobooks – and expanded its distribution channels.” In July of 2023, KKR sold RBmedia to H.I.G. Capital for a reported $1 billion, doubling its initial investment from 5 years earlier.

- In 2022, KKR led a $400 million strategic investment in Skydance, valuing the company at over $4 billion. Skydance is recognized as a diversified media company. The company launched in 2006 as a filmmaker, but has proceeded to expand into television, sports, and video games. From 2009 to 2021, Skydance enjoyed a feature film partnership with Paramount which has led to hits like “Top Gun: Maverick” and installments to the “Mission: Impossible” franchise. This successful partnership points towards Skydance’s current interest in Paramount.

- Apollo’s Entertainment Holdings

- Cox Media Group (CMG) is a news media and entertainment company held by Apollo. CMG reaches over 60 million Americans with 15 market-leading television brands in 9 different markets, 50 popular radio stations in 10 markets, numerous streaming and digital platforms, and a broad advertising network. Apollo acquired CMG in 2019 for a reported $3.1 billion.

- Caesars Holdings Inc. is an American casino and hotel company with locations across the United States. It is one of the most recognized names in the casino and gaming business. Apollo and TPG completed a $28 billion acquisition of Caesars in 2008. Unfortunately, the two firms loaded Caesars with more debt than it could service during the Great Recession. This eventually drove Caesars to file for bankruptcy in 2015 from which it would emerge in 2017. As part of the reorganization, Apollo and TPG were forced to give up $950 million worth of equity to appease creditors and litigators. And just a couple years later, the two firms would sell their final remaining stake in the company for a reported $323 million.

- Yahoo was purchased by Apollo in 2021 for $5 billion. For context, Verizon had acquired Yahoo just five years earlier for $4.8 billion. Yahoo is well known for its digital media properties like Mail, Sports, Finance and also includes TechCrunch, AOL, Engadget, and interactive media brand, RYOT. When Apollo acquired Yahoo and AOL from Verizon, the transaction value represented less than the entities’ combined revenues due to years of struggling attributed to increased competition, dwindling user engagement, and a cluttered strategy. With Apollo at the helm, Yahoo has returned to growth mode driven by M&A, personnel changes, and a focus on higher-margin products. Per Apollo, “the Yahoo deal marks one of its fastest ever returns on investment.”

It’s also worth noting that Sony Pictures, which includes Columbia Pictures and Tristar Pictures, is the fourth largest film studio by market share (11.0%) in the US and Canada. If it were to merge with Paramount (9.4%), the combined entity would challenge Universal (20.3%) for the top spot. While the film and TV studios appear to be a clear fit, questions remain about how Sony would handle Paramount’s streaming and linear TV assets. “There are federal regulations restricting foreign ownership of U.S. broadcast stations, and as a Japanese company Sony could face scrutiny under such rules.”

Buyout News

Global Infrastructure Partners and the CPPIB are acquiring Allete, a utility company serving midwestern US states, at a $6.2 billion valuation. The company generated $1.9 billion in revenues last year and $443 million in EBITDA, up +15% YoY. As we discussed in our 2024 Energy Sector Private Equity Report, utility companies have been a primary target of buyout firms recently driving by increasing demand for grid usage due to the electrification across industries. (Source)

EQT is acquiring tech consulting firm Perficient for $2 billion. The company reported revenues of $906 million last year and $161 million in EBITDA, down -11% YoY. Before the deal was announced, Perficient’s stock price was trading about -70% lower than its high in 2021, which is common for the software industry outside the “big tech” names. In fact, take-private deals in the tech sector are at an all-time high at the moment. EQT is betting the Perficient is undervalued given its roster of Fortune 500 clients, including Ford, Johnson & Johnson, and Caterpillar. (Source)

Sycamore Partners has reportedly emerged as the leading bidder to take department store Nordstrom private. CEO Erik Nordstrom and President Pete Nordstrom pitched the idea of a take-private deal in a board meeting last month. The company currently has a market cap of $3.3 billion. Sycamore is known for its holdings in the retail industry, including Staples and Belk. (Source)

Clearlake Capital and Francisco Partners will carve-out the software integrity business from Synopsys for $2.1 billion. The divestment will help Synopsys pay off debt from its $34 billion acquisition of Ansys. (Source)

KKR is in talks to acquire a stake in utility company PG&E’s power generation unit. The company said it needs capital to upgrade its grid and invest in wildfire prevention. The California wildfires of 2019 caused so much damage to PG&E’s grid that the company filed for bankruptcy. (Source)

Portco News

EQT is interested in selling international school operator Nord Anglia for $15 billion. Some of the buyout firms that have expressed interest include KKR and Hellman & Friedman. Sovereign wealth funds ADIA and GIC are also said to be in the mix for possible minority stake. (Source)

Apax Partners is selling Healthium Medtech, a medical device manufacturer in India, to KKR for $839 million. Apax acquired the company in 2018 and helped it grow through M&A and expanding its presence from 50 countries to 90. Healthium began as a maker of sutures for closing wounds to a multi-category medical device manufacturer. (Source)

Questions? Email us: editor@valueaddpe.com